what is limited fsa health care

An LPHC FSA is used to pay out-of-pocket dental and vision eligible expenses not covered by. The money you contribute to this account is not subject to.

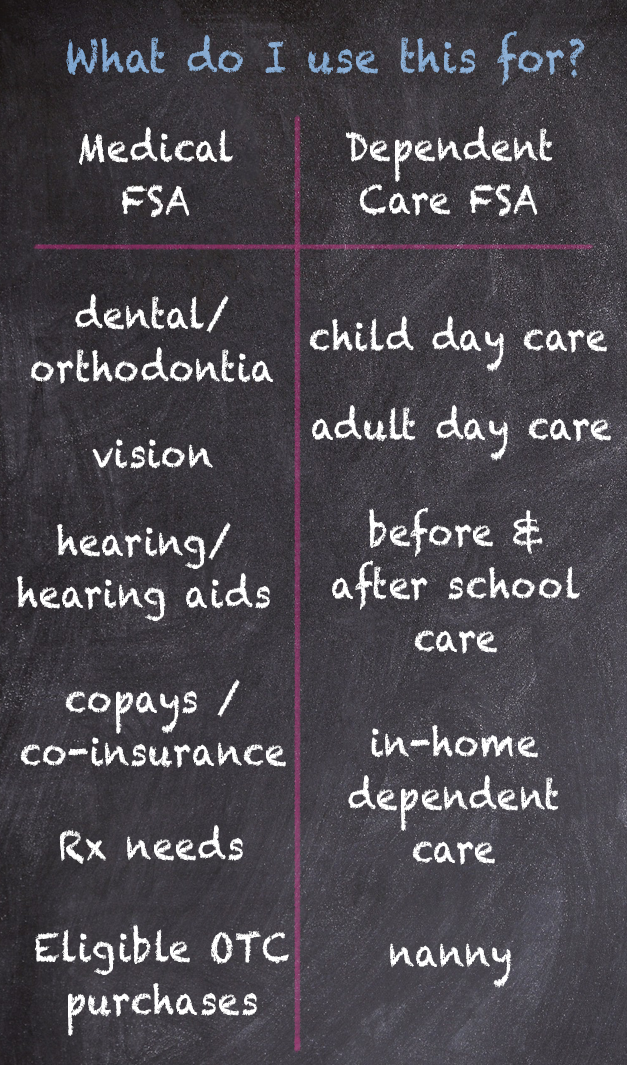

Compare Medical Fsa And Dependent Care Fsa Bri Benefit Resource

Various Eligible Expenses You can use your Limited Expense Health Care.

. 401k plans health savings accounts health and dependent care flexible spending accounts transit benefits and. If youre enrolled in a qualified high-deductible health plan and have an. A limited-purpose FSA flexible spending account is similar to a general purpose FSA except that qualified medical expenses are limited to eligible dental and vision costs for the employee.

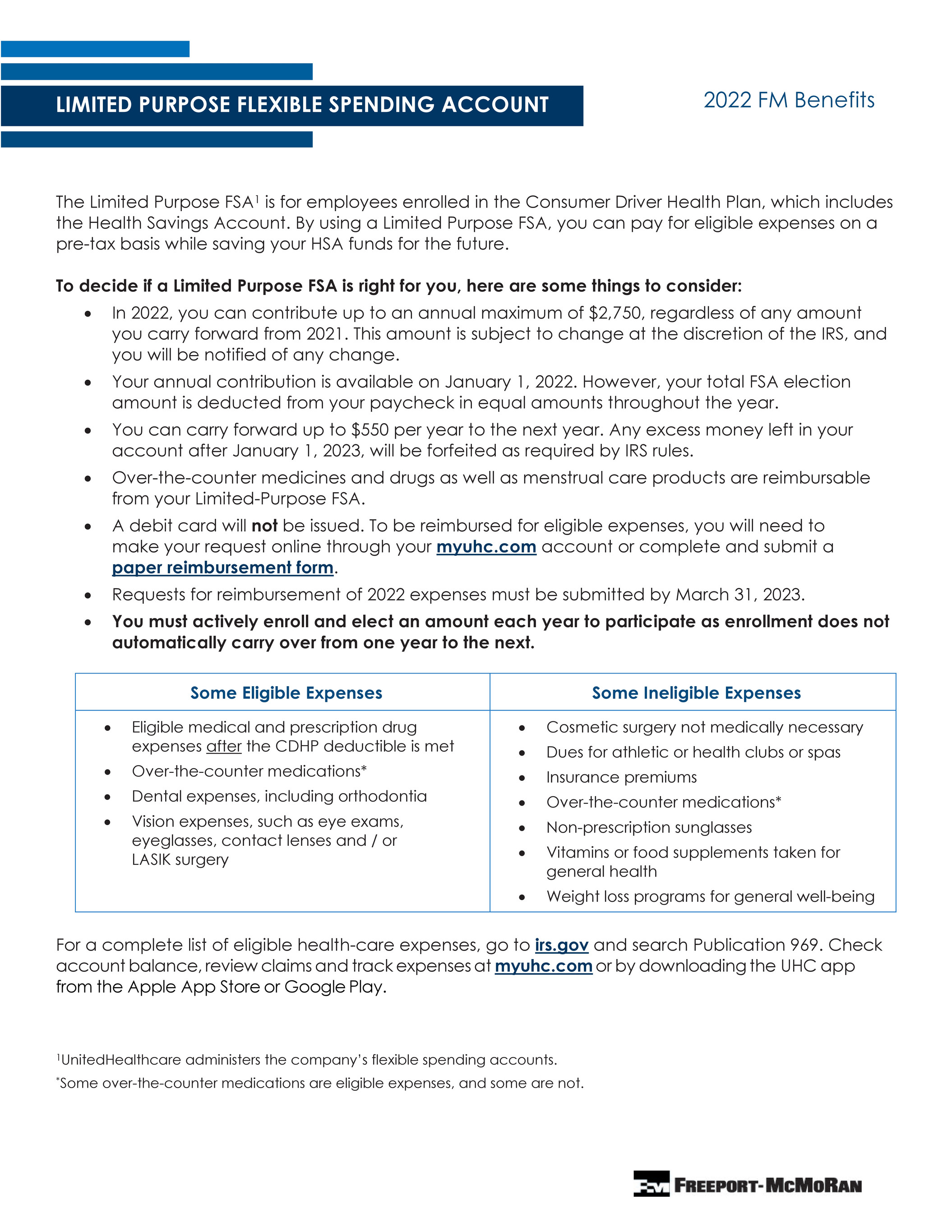

If youre married your spouse can put up to 2850 in an FSA with their employer too. Only certain medical expenses are covered through a Limited. Designed only for submitting eligible dental and vision expenses the Limited Expense HCFSA is used as a replacement for the old good HCFSA when the participant owns.

There are three types of. A handy chart showing 2023 benefit plan limits and thresholds. Limited-Purpose FSA Eligible Expenses You can use your Limited-Purpose FSA to pay for a variety of dental and vision care products and services for you your spouse and your dependents.

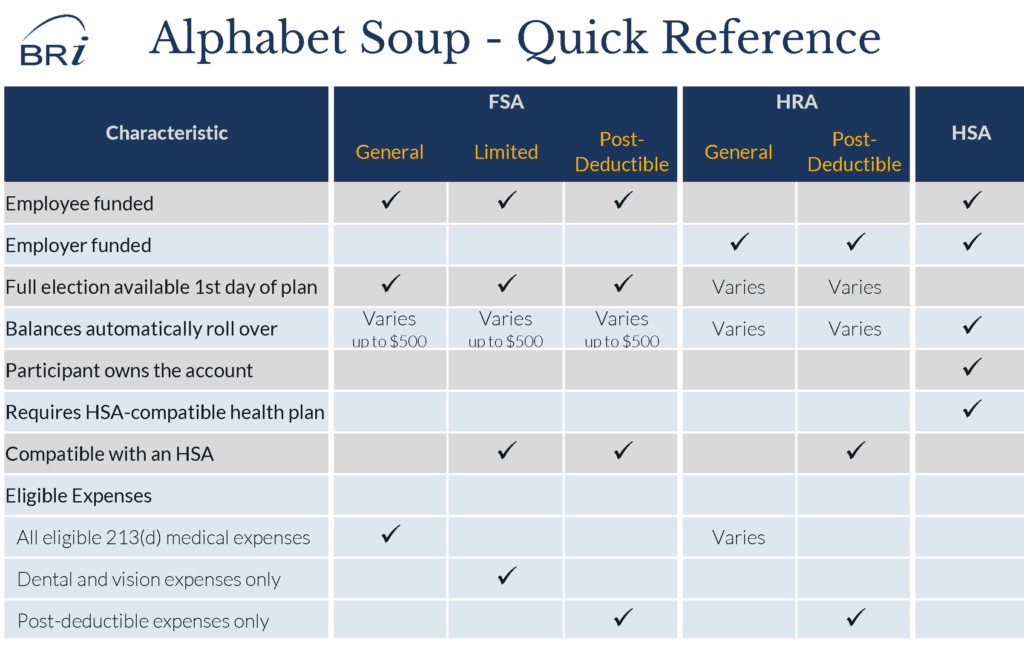

A Limited FSA is often paired with an HSA. A limited purpose FSA is a great companion to a health savings account HSA which you may use to pay for unforeseen qualified medical expenses. One big difference between the.

16 rows Your Limited Expense Health Care FSA pays for qualifying dental and vision services and certain products. A Limited Expense Flexible Spending Account also known as a limited purpose FSA is another type of pretax health account. FSAFEDS offers a Limited Expense Health Care Flexible Spending Account LEX HCFSA for eligible employees in FEHB high deductible health plans HDHP with a health savings account.

A Limited Purpose FSA is a Flexible Spending Account FSA that is compatible with a Health Savings Account HSA. To ensure that the individual remain eligible for an HSA a Limited FSA can be offered that only covers very specific items. A flexible spending account is a benefit program you get through work that lets you set aside money on a pre-tax basis to pay for health care expenses throughout the year.

More important funding dental and vision expenses from. Payroll-funded with annual election. Find eligible expenses or check your FSA account balance.

A Limited Purpose FSA is similar to a Healthcare FSA in that it acts as a tax-advantaged spending account for health-related expenses. The limited purpose FSA is just that it. You may spend remaining dollars in any 2021 FSA account Health Care Dependent Care Limited FSA until December 15 2022.

Limited Health Care Reimbursement Account will sometimes glitch and take you a long time to try different solutions. With a Limited Expense Health Care FSA you use pre-tax dollars to pay qualified out-of-pocket dental and vision care expenses. What is a Limited Purpose Health Care FSA LPHC FSA.

Contribution limits 2022 Health Care FSA and Limited Purpose FSA. A Limited Purpose FSA is a healthcare spending account that can only be used for eligible vision and dental expenses. Health Care FSA and Limited Purpose FSA.

A flexible spending account FSA is an employer-sponsored health benefit that allows employees to pay for qualified out-of-pocket expenses. Limited Purpose Health Care FSA FAQs. Eligible expenses include certain.

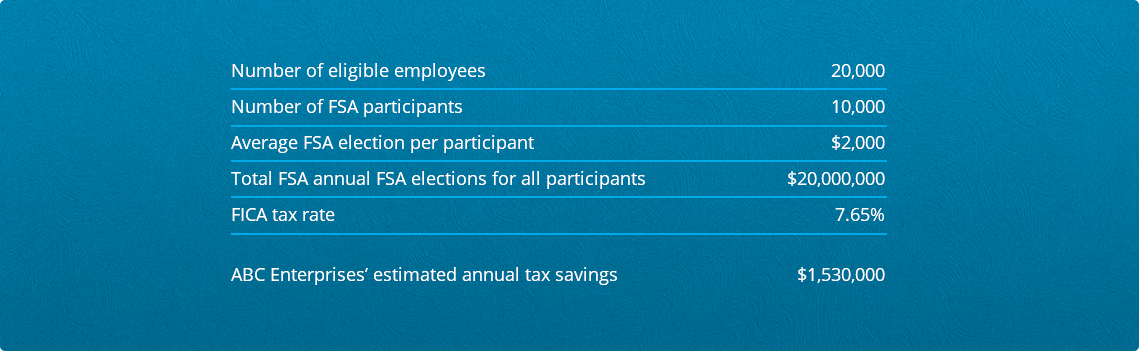

A Flexible Spending Account FSA is an employee benefit that allows you to set aside money on a pre-tax basis for certain health care and dependent care expenses. What is a Limited FSA. Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer.

LoginAsk is here to help you access Limited Health Care Reimbursement. These new limits also apply to limited-purpose FSAs which are used with HSAs to provide employees with tax-advantaged funds to pay for qualified dental and vision care.

What Is An Fsa Unitedhealthcare

There Are Many Benefits Of Having A Flexible Spending Account Taxes Fsa Flexiblebenefits Health Flexibility Accounting Benefit

Flexible Spending Accounts Uk Human Resources

Fsa The Ultimate Guide Ameriflex

Learn How A Limited Purpose Fsa Works

Limited Purpose Fsas Combining Hsas And Fsas Infographic

Anthem Spending Accounts Healthcare And Limited Purpose Fsas

Where Can I Use My Fsa Debit Card Lively

The Perfect Recipe Hra Fsa And Hsa Benefit Options

Page 11 2022 Active Open Enrollment

Flexible Spending Account Vs Health Savings Account Which Is Better

Freeport Mcmoran 2022 Limited Purpose Fsa Page 1

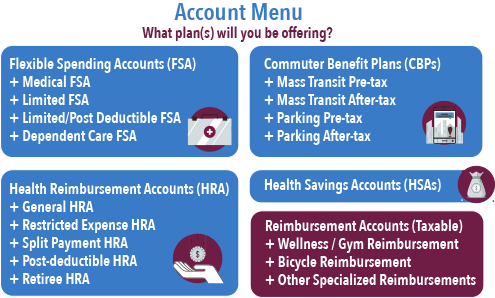

Five Questions To Implement A Pre Tax Benefit Plan Bri Benefit Resource

Fsa Eligible Limited Purpose List Midamerica

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More